A Serial Acquirer with a 30% EPS CAGR, Trading at 5x FCF

A first-world compounder for a third-world multiple.

Argent Industrial is a serial acquirer with a solid track record trading at 5x FCF. Similar companies frequently trade at 15x or higher. Earnings growth combined with a multiple rerating to 10x results in a five-year price target of R135, a 32% IRR.

Summary

Argent Industrial ($JSEART $ART.JO) is in the late innings of a turnaround that has greatly improved the quality of the business as well as its geographical exposure. Because it still carries the reputation of a mismanaged, low-quality South African steel trading firm, it is reflexively ignored by most investors.

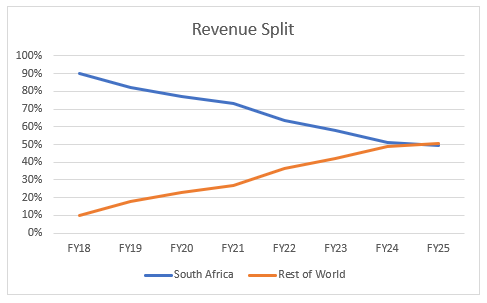

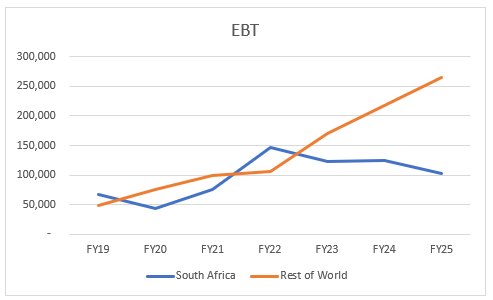

More than 65% of Argent’s earnings now come from its UK- and NA-based manufacturing subsidiaries, and Argent is likely to seek an AIM/LSE listing at some point.

Because it is still trading at South African multiples, you get the opportunity to invest in this UK-focused serial acquirer with a giant net cash pile and a near-decade track record of growing EPS at a 30% CAGR (or 25% in USD terms), for only 5x FY26E FCF.

A Quick History

Argent traces its origins to a company called Scharrig Mining Ltd (also known as Schamin), founded in 1972 by Argent’s current chairman, Teunis Scharrighuisen.

Schamin was principally an earthmoving services provider to the mining industry. As the company grew, it started to diversify, and roughly 20 years after its founding it added an industrial arm. In 1994 it spun off those industrial assets as Scharrig Industrial Ltd.

Mr. Scharrighuisen became the chairman of this newly formed entity. Schamin employee Treve Hendry, then only 30 years old, was appointed CEO a couple of years later, in 1997.

Hendry has been in charge of Argent ever since. He was responsible first for a twenty-year period of underperformance, and later for the transformation that made Argent what it is today.

Given this past mismanagement and the fact that serial acquirers are highly sensitive to the quality of the C-suite, the first obstacle is gaining conviction that the CEO is now a sensible capital allocator. To do so, it is useful to look at Argent’s history, and how its managers changed their thinking alongside developments in the company.

Argent’s history is best understood when split into three parts: the period spanning from its listing in 1994 up to a traumatic incident in 2015; the approximately two-year period of strategic rethinking that followed; and finally, the implementation of that new strategy from 2017 onward.

1994 to 2015:

Scharrig Industrial was at first focused on supporting the industries of its forefather by refurbishing engines and building tipper trucks. Five years after it was listed, in 1999, it changed its name to Argent Industrial.

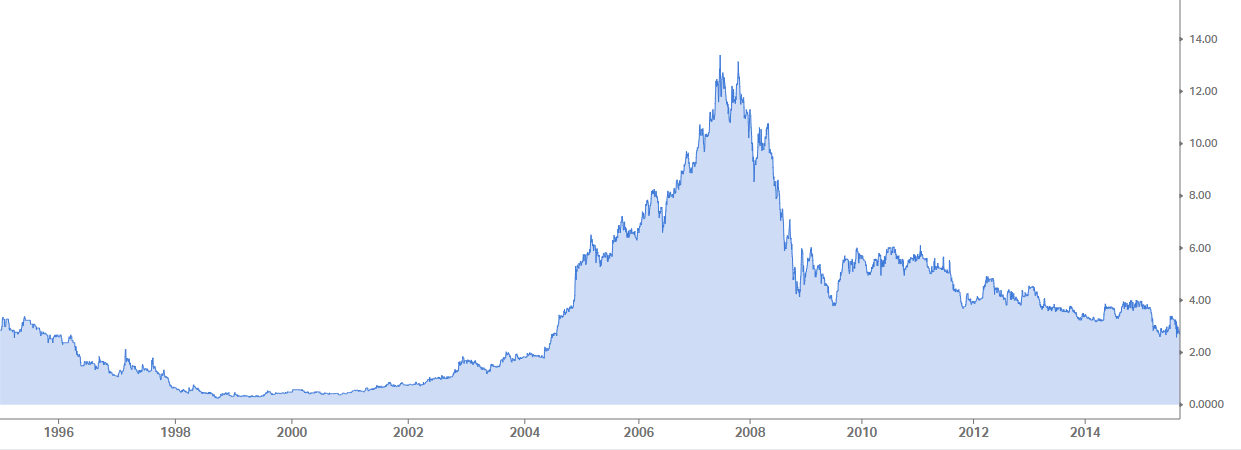

After this name change, Argent began to diversify. It bought a set of steel trading firms, a fireplace manufacturer, a quarry, a cement plant, and more. While the stock did decently going into the GFC, it all came crashing down afterward, and over the first twenty years of Argent’s history shareholder returns after inflation were basically negative.

A Change of Strategy:

In 2015, an incident occurred at one of Argent’s subsidiaries. Argent had been in a labor dispute with the National Union of Metalworkers (NUMSA) over proposed pay cuts at one of its holdings, an automotive components firm called Giflo Engineering. Unable to come to an agreement with the 230 striking employees, the dispute escalated. An April 2015 press release read as follows (emphasis mine):

The Board of Directors has taken the decision to conclude operations at Giflo Engineering […].

The decision was made on the back of poor margins and a labour dispute with NUMSA which has resulted in a labour strike which started on the 12th of January 2015 and is still currently ongoing.

The strike has been incredibly violent with a number of our working staff and staff of our suppliers and customers being hospitalized. Our trucks, as well as those of our suppliers have been damaged, working staff houses have been set alight and the factory has been brought to a halt as a result of the strikers stoning all vehicles in the vicinity of the Giflo factory and cutting off the company’s water supply.

Argent’s subsidiary was physically besieged by its employees, who were in turn being spurred on by their national union. Perhaps it was at this point that management realized South Africa was not a good place to be doing business.

Although it is hard to top such a shocking incentive for strategic tinkering, there soon came another, more positive, force into play.

In September 2016, Argent filed a SENS announcement that UK-based fund Milkwood Capital had acquired a 6.6% stake in the company. In October 2017, that figure had increased to 20%.

Milkwood is not strictly an activist fund. But it does like to exert their influence where simple changes in capital allocation can unlock a lot of value, working with existing management where possible.

With Argent’s management having soured on South Africa, and there being a smart new shareholder on the register keen to improve capital allocation, the time was right for change.

2017 to 2025:

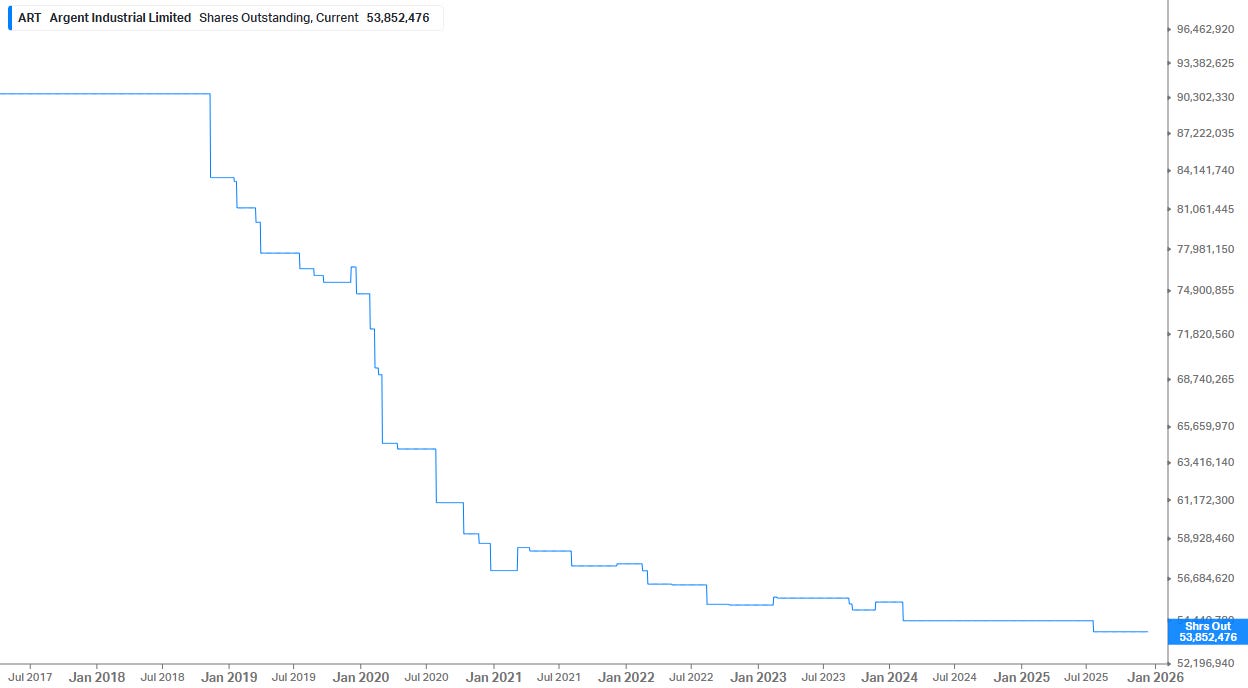

With Milkwood guiding them, management rapidly improved their capital allocation policies. They suspended the dividend. They closed and divested underperforming assets in SA, and deployed the proceeds into cheap, stable, higher-margin UK manufacturing businesses.

They also implemented an aggressive buyback campaign, reducing shares outstanding by nearly half:

The impact these decisions had on Argent’s financials was staggering. EPS has grown at 30% per year (in ZAR) since 2017, and the share price has followed suit:

Argent Today

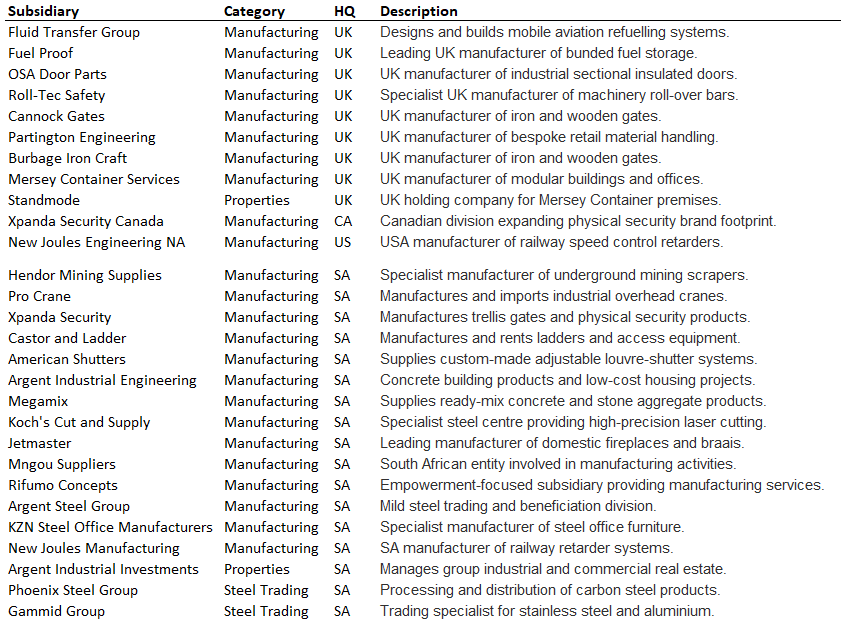

Below you will find Argent’s current portfolio. It consists of nine manufacturers of various sorts in the UK (and two in North America), their general theme being the fabrication of metal products. I estimate that about 65% of earnings are from these regions.

The subsidiaries in SA are a mix of legacy assets that they are still trying to get rid of, as well as some profitable manufacturing companies that are less likely to be sold.

(By my estimates, no subsidiary is responsible for more than 10-12% of net profit.)

Highlighted below are some of the subsidiaries’ products, along with an estimation of that company’s profit contribution to the group:

Fluid Transfer Group (UK; est. ~10% of total net profit). Its main products are aircraft refuellers:

Fuel Proof (UK, ~9%), fuel storage tanks:

OSA Door Parts (UK, ~7%), overhead doors:

Pro Crane (SA, ~10%), overhead cranes:

Xpanda Security Gates (SA and Canada, ~9%), security gates:

Perhaps one ought to spend some time getting to know these businesses, but in-depth analysis of specific subsidiaries is kind of beside the point here. What matters is that the portfolio is a diversified set of economically resilient businesses that should be able to weather most macro environments.

Acquisition Track Record

Now, none of these businesses will be phenomenal on their own, and there isn’t a very clear overarching theme that suggests inter-company synergies (aside from savings on raw materials).

Management’s strategy appears to be simply: buy decent metal fabrication businesses for a low multiple, spend capex on them where necessary, extract modest synergies, divest unproductive assets (e.g. owned property), and leave the original managers in place to run the show.

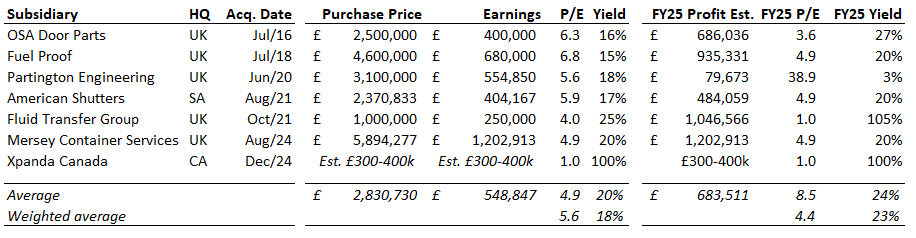

For an overview of how they have performed with this strategy thus far, see below each acquisition made since 2015, along with the pricing terms at the time and my FY25 estimates.

Important caveat: Argent does not provide a lot of subsidiary-level financials beyond the acquisition press releases, especially so for its UK holdings. One can glean a lot from annual filings made to the UK government’s Companies House website, but actual FY25 earnings might differ significantly in some cases. In addition, the purchase price has not been adjusted for any growth capex, so actual FY25 multiples might be a little higher than shown here.

Some of these acquisitions were total home-runs, notably Fluid Transfer Group, which is now earning annually the entire sum that Argent paid to acquire it in 2021, as well as Xpanda Canada, which was a small bargain purchase at 1x earnings just recently. The other subsidiaries experienced modest earnings growth, though nothing stunning. Partington Engineering, which makes trolleys for retail stores, has been the only mistake so far.

Either way, at Argent’s current valuation it doesn’t really matter if the subsidiaries improve or deteriorate a little after acquisition — what matters is that capital is not incinerated on unproductive investments.

Now the main assumption of this thesis is that Argent will be able to realize these >15% acquisition yields shown in the table for a long enough period. Given Argent’s small size (<$80mn EV) and management’s knack for unglamorous metal fabrication niches, it seems likely that they will be able to keep fishing in the tiny-and-ugly pool, where there is little competition from PE.

Add all this together: the large and fairly uncontested pool of acquisition targets, as well as the track record of paying low entry multiples along with decent stewardship thereafter; and I find it reasonable to assume that they can keep executing this strategy for at least five more years, probably much longer.

Valuation

Argent’s businesses are capital-light with FCF conversion being around 90% of net income. Extrapolating the first half of FY26 suggests ~R250mn in FCF for FY26E. At a current EV of R1.3bn, Argent is trading at ~5x FCF.

It is perhaps unrealistic to expect the historical EPS CAGR of 30% to continue into the future, which is why I am modelling 15% p/a instead (which translates to a double in five years).

There are multiple reasons for this. Firstly, changes in the rand accounted for ~5pp of that growth. Buybacks are also less accretive than they were when the stock was trading at 3x. In addition, deal sizes (and thus multiples) might increase after all; and large COVID-era bargain acquisitions (like Fluid Transfer Group) might not reoccur in the future.

On the other hand, the company has ~R500mn net cash waiting to be deployed. Doing so at a 15% yield (which is conservative given historical deal multiples) would grow EPS by 30% in year one. With shares still trading at 5x, buybacks would be even more accretive.

A 20% FCF yield seems pretty good for a business that in five years’ time is likely to have doubled FCFPS using the lower range of EPS growth estimates, with nearly all of its exposure coming from the UK (or similarly reputable countries) — and then still with a long growth runway ahead.

Not to mention the optionality of an AIM/LSE listing, which could double the multiple overnight.

Multiple expansion from 5x to 10x along with 15% FCFPS growth results in a quadrupling of the share price over the next five years to R135, a 32% IRR.

(The company now also pays a meaningful dividend again, 4% yield at current prices.)

Risks

Country/political:

Argent still has significant exposure to South Africa, with all the obvious risks to both the operating companies as well as the holding.

Some mitigating factors are that Argent will decrease its SA exposure further through divestments in SA and acquisitions in first world countries. Possibly, they will insulate the holding company through a relisting on the AIM or LSE.

(Note that this last point is still speculative. We have no public indication from management that they will seek a listing in the UK, but it seems like an obvious choice given Argent’s earnings profile, as well as the fact that the CEO is a British national who is domiciled in the UK.)

Another factor to consider is that SA today is not what it was even a couple of years ago. The ANC lost a 30-year parliamentary majority in 2024, and they now rule in coalition with the Democratic Alliance, which is considered much more business-friendly.

In fact, there are some green shoots showing: SA received its first credit upgrade from S&P in nearly two decades in late 2025. Energy supply is also more stable (load-shedding is way down), the Rand is strengthening, and unemployment/growth figures look encouraging (although they are still weak in absolute terms).

My point here is not that South Africa is about to undergo some economic miracle, but that the economic catastrophe one hears about online does not necessarily describe the reality on the ground.

Currency:

Argent is naturally hedged against fluctuations in its listing currency because most of its earnings are in GBP. Still, as long as Argent owns South African businesses and is listed in Johannesburg, investors will have ZAR exposure.

Management:

Both the chairman and the CEO are the same individuals who oversaw a 20-year period of underperformance from Argent’s IPO to 2015. Although sometimes the best people to clean up a mess are the ones who made it, one must keep in mind that they can make mistakes.

Working in the other direction is the long and successful track record subsequent to that initial period of underperformance, as well as Milkwood’s strong influence on capital allocation.

In addition, there is fairly strong insider alignment and a solid incentive structure. The CEO owns 5.5% of the shares, equal to ±13x his annual comp package. The chairman owns 1.5%, and other directors own 2%. Incentive structures are based on subsidiary-level profit targets, EPS growth, ROCE, as well as a specific incentive for pruning the portfolio (i.e. when a property or company is sold for a price above internal NAV, directors get 20% of the excess as a bonus).

(As an added benefit, management commentary is fun to read. Here’s a line from the CEO’s review of FY23, when the ANC still had an absolute majority:)

“Domestically the consequences of the perfect Fun Show put on by the current elected party has made an absolute mess of the SA markets and is the inspiration to place the company’s operations and production elsewhere in the world.”

Conclusion

Argent has transformed itself from a low-quality South African steel trading firm into a profitable UK-focused serial acquirer. Given the capital allocation track record, the small and decreasing exposure to South Africa, the long growth runway, and a possible relisting in the UK, I think Argent is cheap at R33.75.

Catalysts

High FCF yield

More divestments

More M&A

AIM/LSE relisting

How to Buy

IBKR does not offer access to the JSE.

US investors can get access through Fidelity, EU investors through Saxo.

Disclosure

This article is for entertainment purposes only.

JibbyCap is long $JSEART.

Not financial advice.

Questions/comments: contact@jibbycap.com.

I would very careful with Argent. We spent a lot of time on this company and spoke with many of the relevant stakeholders in South Africa. Treve Hendry, the CEO for the last 30 years, was deeply involved in a fraud back in 07/08 between Argent, Scharriguisen, SOC, and the GAT. Basically, Jason Holland and Cas Scharriguisen (one of the brothers who founded Argent), siphoned/stole money out of Sentula Offtake Company (SOC) which they were on the board of. They moved this money to a secret bank account. Eventually when the rest of the board members realized the money was missing from SOC, they approached Jason and Cas about it. Long story short, Jason and Cas convinced Treve Hendry to use Argent as a middleman to plug the holes in the SOC company accounts.

Eventually the court in 2018 ruled that Cas Scharriguisen was liable. Cas then fled the country. Cas’ brother, Tony, who we are quite certain knew about what was happening in this fraud, is currently the chairman of the board of Argent.

Generally we have been very wary about the people involved at Argent. What they have done with the company the last few years has been much better than the past. However, at a certain point, you have to take a step back and really understand the risk of investing in Argent.